Instructions for filling out

IRS Form 5695

Instructions for filling out IRS Form 5695 for 2020

Claiming the ITC is easy. All you need to do is complete IRS Form 5695, “Residential Energy Credits,” and include the final result of that form on IRS Form 1040. Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells. We’ll use the national average gross cost of a solar energy system as an example.

1

First, you will need to know the qualified solar electric property costs. That is the total gross cost of your solar energy system after any cash rebates, including state rebates and incentives. Add that to line 1. If your taxes are prepared by a qualified CPA, you should only need to report to your CPA what this number is and ask the CPA to complete the remainder of your Forms 5695 and 1040.

2

Insert the total cost of any additional energy improvements, if any, on lines 2 through 4, and add them up on line 5.

3

On line 6, multiply line 5 by 26%. This is the amount of the solar tax credit.

4

Assuming you are not also receiving a tax credit for fuel cells installed on your property, and you aren’t carrying forward any credits from last year, put the value from line 6 on line 13.

5

Now you need to calculate if you will have enough tax liability to get the full 26% credit in one year.

6

Complete the worksheet on page 4 of the instructions for Form 5695 to calculate the limit on tax credits you can claim. If you are claiming tax credits for adoption expenses, interest on a mortgage, buying a home for the first time, or buying a plug-in hybrid or electric vehicle, you will need that information here. (For this example, total federal tax liability is $7,000.)

7

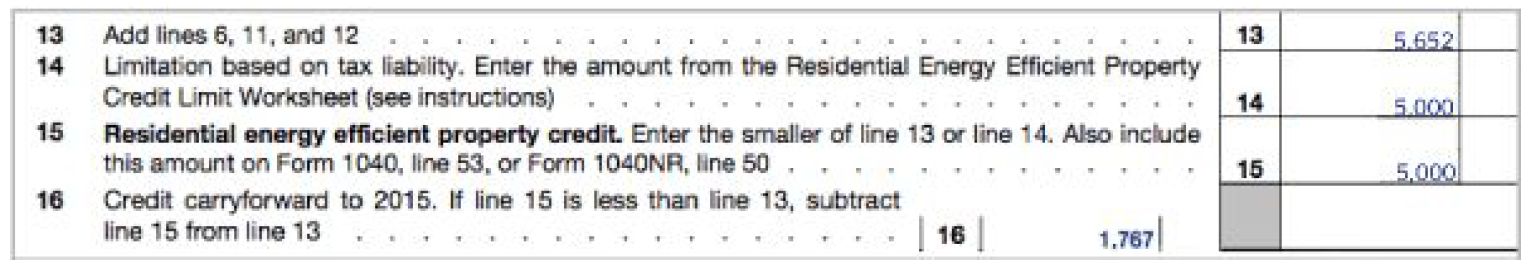

Enter the result on line 14 of Form 5695. Review line 13 and line 14, and put the smaller of the two values on line 15.

8

If your tax liability is smaller than your tax credits, subtract line 15 from line 13, and enter it on line 16. That’s the amount you can claim on next year’s taxes.

9

Add credit to Form 1040

10

The value on line 15 is the amount that will be credited on your taxes this year. Enter that value into Form 1040, line 53 (or Form 1040NR, line 50).